Income-Based Strategy for Real Estate Investors

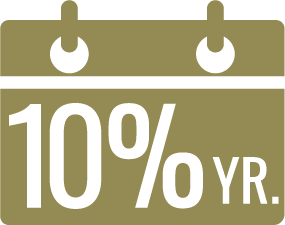

Earn 10% annualized return

with monthly dividends

Get Started

Choose your path below. If you're ready to invest, gain access to the data to evaluate this particular investment opportunity or learn more about the value of private credit funds.

Discover the Value of Real Estate Debt Funds

Designed for capital preservation and consistent yield, the Park Place Real Estate Fund offers the many benefits of real estate debt: higher yields, diversification, and low correlation with traditional asset classes.

These last traits lower overall risk and increase the likelihood of principal protection.

- Capital Protection

- Diversification from Equities

- Stable, Predictable Returns

Tackle a Range of Investment Objectives

Whether you are looking for compelling returns, a more diversified investment portfolio or a durable income stream, the Park Place Real Estate Fund can help meet those objectives, and more.

The Fund pays a 10% annualized return with dividends paid monthly. Investors have the option of receiving monthly cash distributions for income purposes or reinvesting distributions to achieve a growth objective.

Private residential real estate is uncorrelated to the publicly traded stock and bond markets. The Fund’s business-purpose loans for this asset class provide enhanced portfolio diversification characteristics for an investor’s portfolio.

The portfolio consists of short-term, fixed-rate, senior-secured loans, backed by underlying real estate assets, providing investors with the confidence of receiving consistent monthly income distributions.

A Focus on Capital Preservation

The Park Place Real Estate Fund is meticulously managed to mitigate investment risk and preserve investor capital. The Fund aims to achieve the capital preservation objective by:

- Adhering to strict underwriting standards

- Lending only to asset-backed borrowers

- Offering only senior secured loans in the capital stack

- Diversifying risk across a broad portfolio of loans

.png?width=2000&name=29626%20PP%20A%20Focus%20on%20Capital%20Preservation%20Collage%203@2x%20(2).png)

Something Powerful

Tell The Reader More

The headline and subheader tells us what you're offering, and the form header closes the deal. Over here you can explain why your offer is so great it's worth filling out a form for.

Remember:

- Bullets are great

- For spelling out benefits and

- Turning visitors into leads.

Calculate 8% Return

Results

Rate of Return: